To make sure you never miss out on your favourite NEW stories, we're happy to send you some reminders

Click 'OK' then 'Allow' to enable notifications

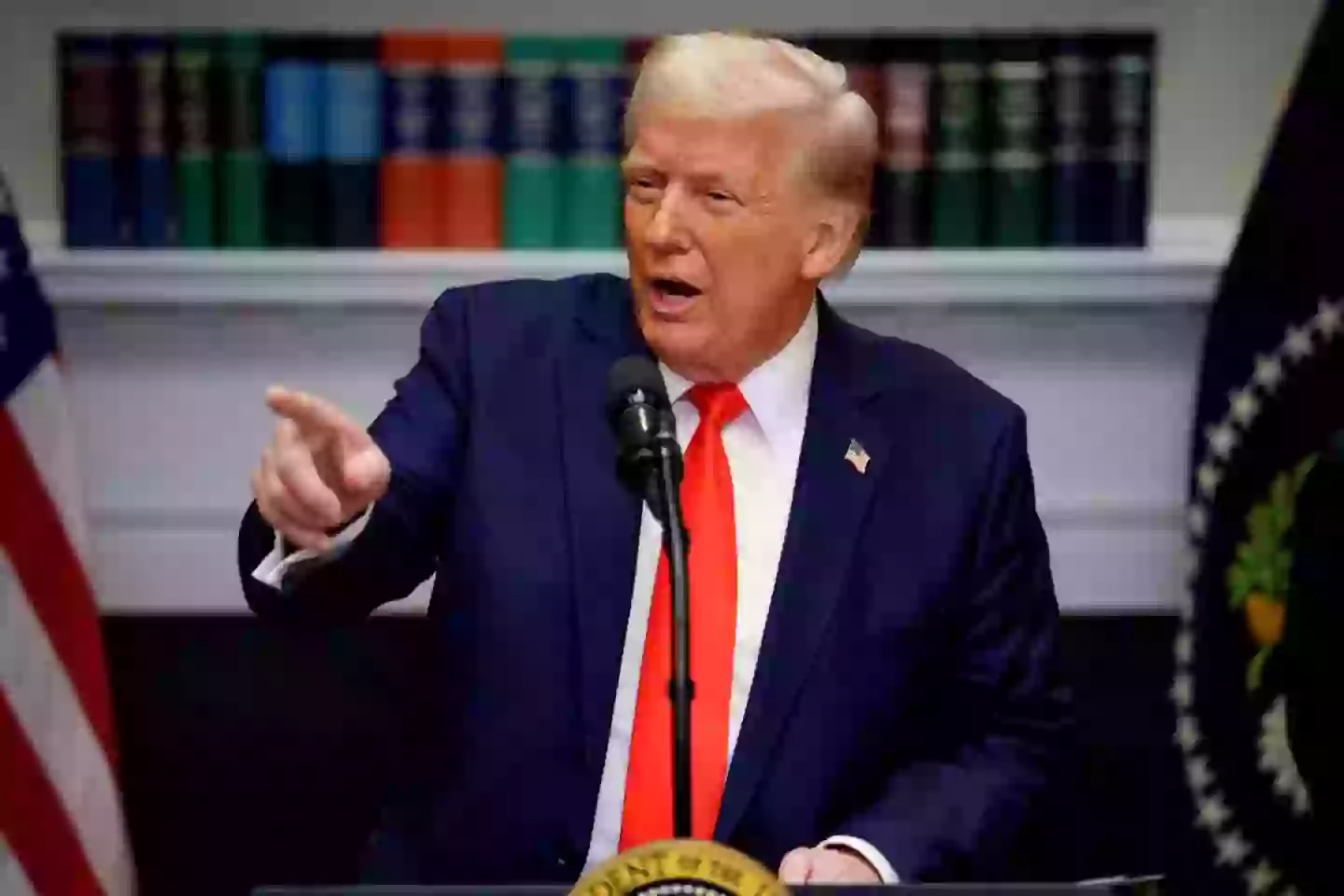

Donald Trump’s public endorsement of Elon Musk's Tesla may have given the company a temporary boost.

But, financial experts warn it could do more harm than good in the long run.

On Tuesday (11 March), Trump publicly backed the world's richest man, praising him and calling him a 'patriot' as five Teslas were lined up in the White House driveway.

Advert

Tesla investors cheered as the president announced that he even purchased a brand-new Tesla for himself - a move that seemed to briefly lift investor confidence.

But experts warn the unusual presidential backing is turning the electric car marker into a political brand.

“Tesla is becoming a political symbol of Trump and DOGE, and that is a bad thing for the brand,” said Wedbush Securities financial analyst Dan Ives, referring to the advisory group in charge of cutting government spending led by Musk. “You think it’s helping, but it’s actually hurting.”

Advert

Although suffering a 15% drop the day before - and possibly the worst single day sell-offs in Tesla’s history a day earlier - Tesla stock ended Tuesday (12 March) up nearly 4%.

But even before Trump’s endorsement, Tesla has been facing a rough year so far. For one, falling global sales in 2025 have led to shares dropping to 45%.

The EV company has also been hit hard by rival companies, especially from Chinese electric vehicle (EV) manufacturers.

Several auto industry analysts have also pointed to Musk’s close ties to Trump and right-wing politics - a point that some believe led to the protests at US Tesla showrooms and reports of vandalised vehicles on the streets.

Advert

Meanwhile, consumers worry that CEO Musk’s heavy involvement in politics is taking his focus away from Tesla, which could lead to fewer deliveries and profits in 2025.

As the head of the Department of Government Efficiency (DOGE), Musk has promised massive federal worker layoffs and aims to drastically reduce government spending by $2 trillion.

Furthermore, the drop in Tesla stock could create further financial challenges for the company.

Advert

First, discounted employee stock was used as a way to incentivise Tesla workers to invest in the company. But with the stock so low, many of those 'discounted' shares are now worth more than the current market price - so the whole incentive is made meaningless.

Second, the stock drop could make it harder for Tesla to raise capital. In 2020, the company sold $12 billion worth of shares to help fund factories in Berlin and Texas and invest in self-driving technology. A lower share price means Tesla would get less funding if it tried to raise money through new stock offerings.