Investing on the stock market is always a gamble, but you'd be in for a surefire winner if you'd held onto $1,000 worth of Apple stocks bought two decades ago.

While Apple was certainly huge at the turn of the millennium, the company has only continued to grow with the introduction of new products, features, and a much larger market share.

That has seen their stock price rise accordingly, and they're currently the most valuable company in the world with a current market cap of $3.67 trillion and an individual share price of $242.74.

Looking all the way back to 20 years ago and you get quite a different picture, as the company that made the iPhone and iMac had a relatively minuscule market cap of just $17.19 billion in December 2004.

Advert

This represents a staggering increase of 21350%, and such growth would have made you quite rich if you'd been smart enough to invest $1,000 in the tech company back in the day.

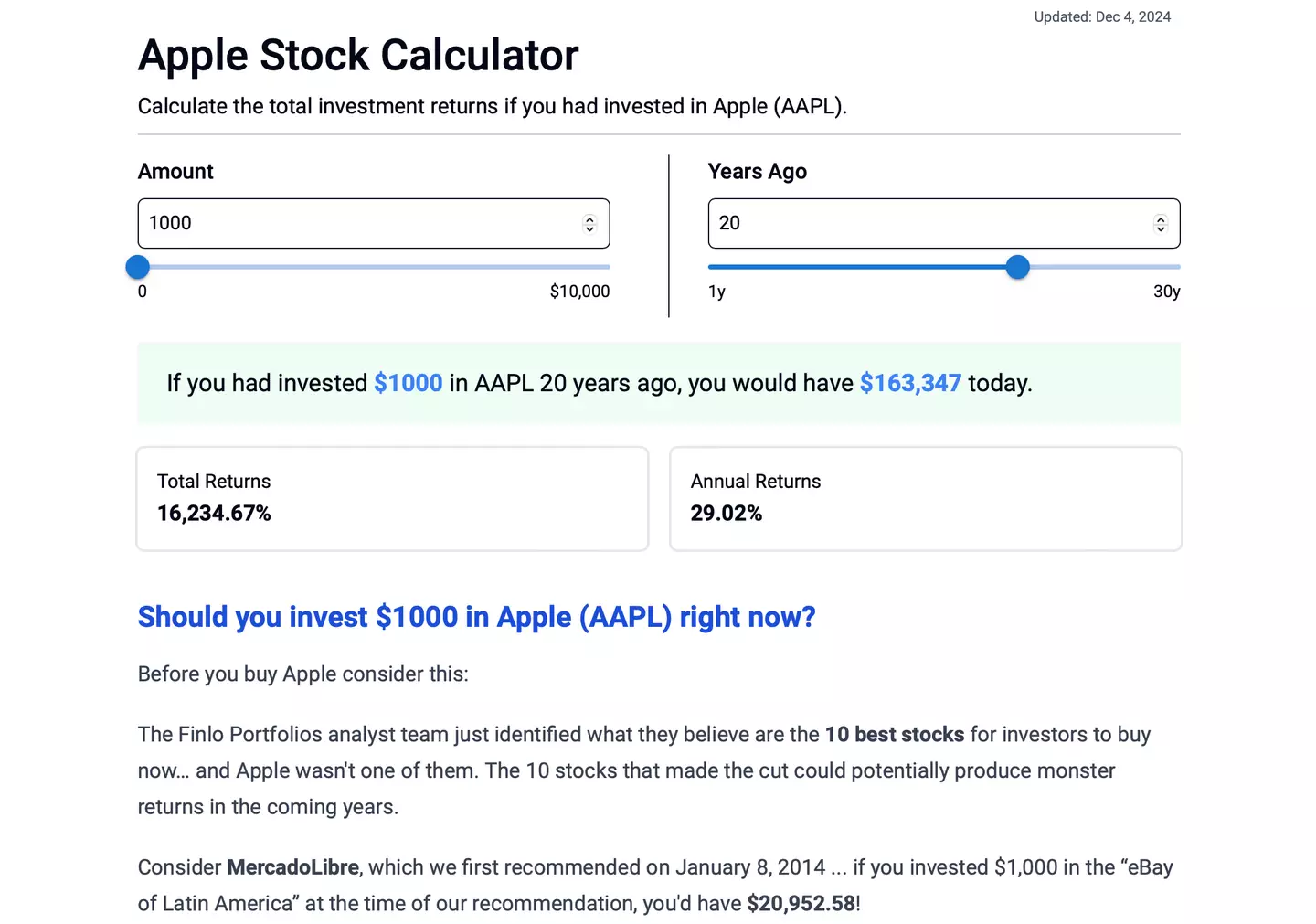

Investing that $1,000 in 2004 and not touching it until now would leave you with $163,347 worth of stocks, according to Finlo's Apple Stock Calculator, marking a 16,234.67% return on investment, or an annual return of around 29.02%.

While it will definitely have been hard to resist the temptation of selling - and there's no doubt we'll look again in another 20 years to think how silly you'd have been to sell now - sometimes the easiest thing to do is simply forget about it, which was the case for NFL star Rob Gronkowski who has made his own little fortune after completely forgetting about his own Apple investment.

20 years is a long time though, and you'd still have yourself a mighty fine investment if you'd have waited just a decade. $1,000 worth of Apple stock in 2014 would now be worth $7,658 today, and while this pales in comparison to the mind-blowing 20-year figure, it's still a 655.82% ROI.

Five years is even less impressive though, as you'd mark a 189.89% increase with a current sale value of $2,899. This is understandable considering Apple's recent dominance on the stock market, and you'd still nearly triple your input in just half a decade.

Even a year can make such a huge difference though as shown by the calculator, as switching between the aforementioned 20 years and 21 years would net you an extra $393,451 with an overall sale value of $556,798.

It goes to show that timing is as much a part of mastering the stock market as luck, as getting in on a company at their low point and anticipating the heights of the future can really make you rich.